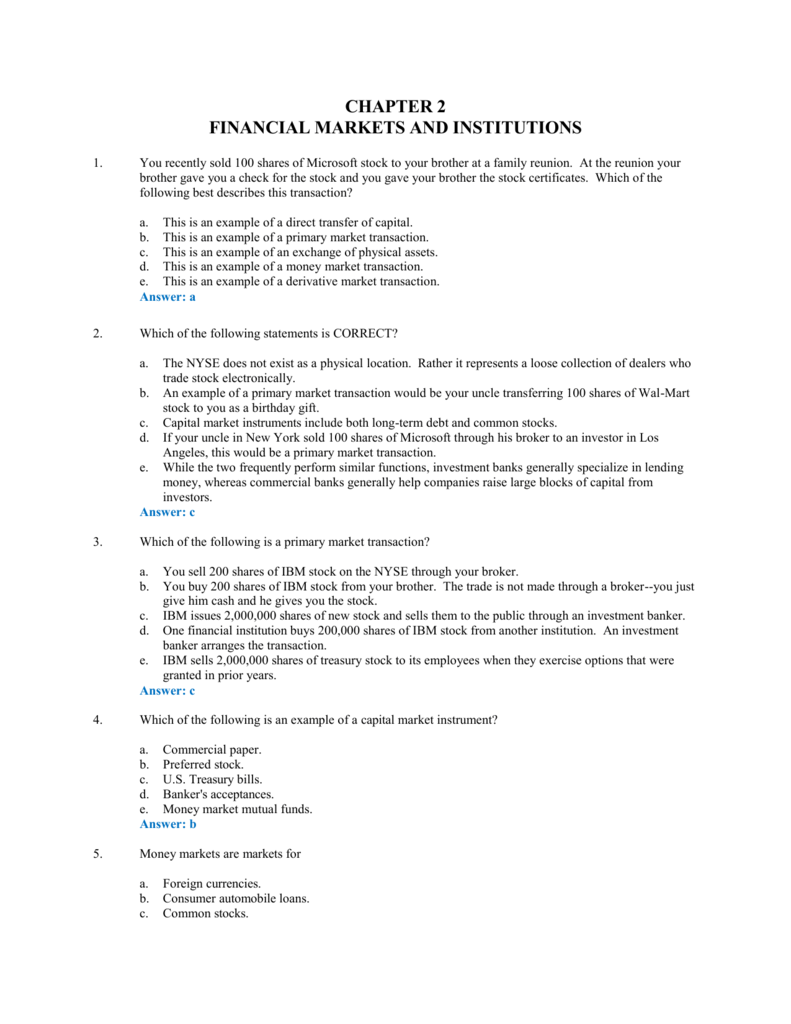

1 Which of the Following Is a Primary Market Transaction

Hence the initial public offer otherwise known as IPO is a good example of a primary market transaction. Buying stock through an app rather than a brokerage website.

Chapter 1 Assignment Finc Docx Chapter 1 Assignment 1 Which Of The Following Statements Is Most Correct A An Example Of A Primary Market Course Hero

Sale of a new share of stock to an individual investor C.

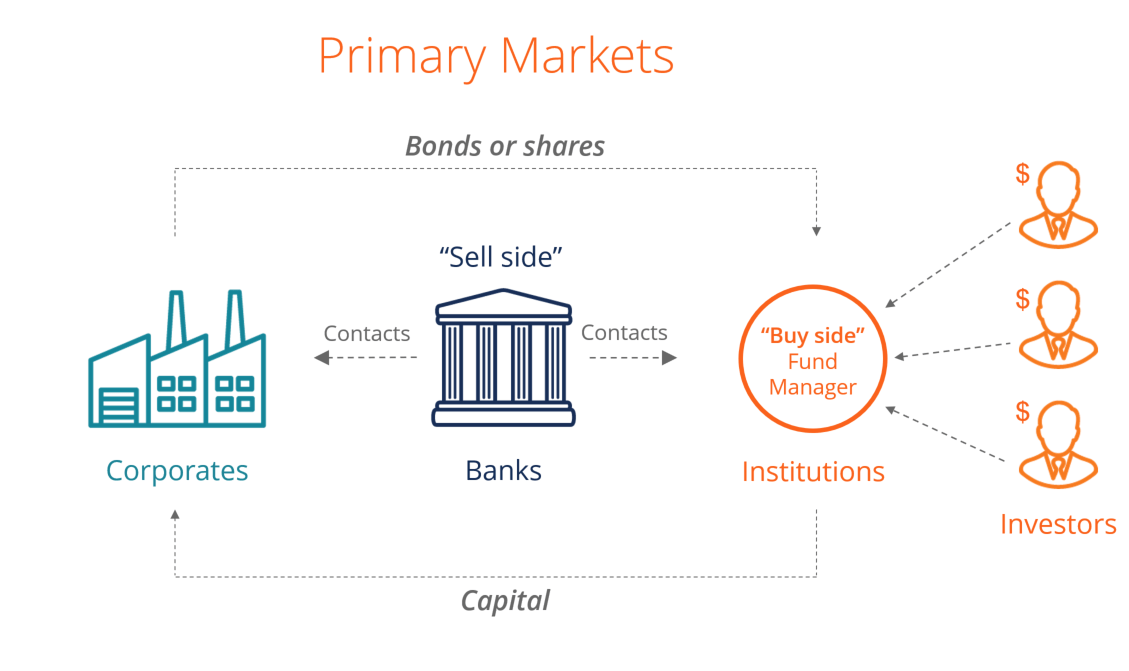

. Cthe NYSE is an example of an over-the-counter market. Above all the primary market issues new securities on an exchange to allow companies governments and others to raise capital. Sale of a new share of stock to an individual investor.

You buy 200 shares of IBM stock from your brother. Which of the following is a primary market transaction. Investor A sells her stock to investor B Gift of stock from one shareholder to another shareholder O.

Valerie purchased newly issued shares of velcro inc. Gift of stock from one shareholder to another shareholder. The public market trading that starts immediately after those initial shares are sold are secondary market transactions.

The subsequent trading of shares outstanding is done in the secondary market. If an investor sells shares of stock through a broker then it would be a primary market transaction. Securities issued through a primary market can include stocks corporate or government bonds notes and bills.

Which one of the following transactions occurred in the primary market. One financial institution buys 200000 shares of IBM stock from another institution. The primary market transaction is.

Which one of the following is a primary market transaction. The primary market refers to the market where securities are created and first issued while the secondary market is one in which they. The trade is not made through a broker--you just.

Sale of currently outstanding stock by a dealer to an individual investor b. Primary market transaction refers to the transaction in which securities are sold for the first time by a corporation to the public. You sell 200 shares of IBM stock on the NYSE through your broker.

Johnson Johnson issues 2000000 shares of new stock and sells them to the public through an investment banker. The primary market is where new stocks are created. Up to 256 cash back The following financial statement information is for an investorcompany and an investee company on January 1 2013.

Sale of currently outstanding stock by a dealer to an individual investor O e. Primary Market Transaction means any transaction other than a secondary market transaction and refers to any transaction where a Person purchases securities in an offering. One financial institution buys 200000 shares of Johnson Johnson stock from another institution.

Sale of a new share of stock to an individual investor Interest earned on both the initial principal and the interest reinvested from prior periods is called. Which of the following statements is CORRECT. Sale of a new share of stock to an individual investor O b.

Therefore a share purchased of a start-up company in a public offering is an example of primary market transaction. It is the platform for investors to purchase stocks of an entity that goes public for the first time. You sell 200 shares of IBM stock on the NYSE through your brokerb.

1Which of the following is a Primary Market transaction. Stock ownership transfer from one shareholder to another shareholder. Capital markets deal only with common stocks and other equity securities.

Sale of currently outstanding stock by a dealer to an individual investor. The IPO itself is a primary market transaction where the company raises investment capital for its own use. Primary market transaction is one in which newly created securities such as stocks and bonds are sold to investors for the first time.

The trade is not made through a brokeryou just give him cash and he gives you the stockc. On January 12013 the investor companys common stock had a traded market valueof 105 per share and the investee companys common stock had atraded market value of 19 per share. A dealer buying newly-issued shares of stock from a corporation Primary market as the securities are new.

Which one of the following is a primary market transaction. You buy 200 shares of IBM stock from your brother. Initial public offering of shares is done in the primary market.

Thus sale of a new share of stock to an individual investor is a primary market transaction Option E. Each stock has a standard deviation of 25 and their returns are independent of one another ie the correlation coefficients between each pair of stocks. Sale of currently outstanding stock by a dealer to an individual investor B.

Alpha inc a publicly owned company bought shares of new town press also a publicly owned company. Multiple Choice Purchasing a stock on the New York Stock Exchange NYSE rather than one of the smaller stock exchanges. Which one of the following is a primary market transaction.

AIf you purchase 100 shares of Disney stock from your brother-in-law this is an example of a primary market transaction. As such sale of a new share of stock to an individual investor is a primary market transaction. You sell 200 shares of IBM stock on the NYSE through your.

1 on a question Which one of the following is a primary market transaction. Sold shares of plastics tech on nasdaq. E Sale of a new share of stock to an individual investor.

1 Answer to 1. Stock A has a beta of 08 Stock B has a beta of 10 and Stock C has a beta of 12. October 17 2021 thanh.

The primary market is where securities are created so they can be sold to investors for the first time. Gift of stock from one shareholder to another shareholder E. Stock ownership transfer from one shareholder to another shareholder D.

IBM issues 2000000 shares of new stock and sells them to the public through an investment banker c. Portfolio P has 13 of its value invested in each stock. Gift of stock by a shareholder to a family member.

Buying a new issue of a bond directly from the. Which of the following is a primary market transactiona. Which of the following is a primary market transaction.

An investment banker arranges the transaction. What is a primary market transaction. Answer 1 of 3.

BIf Disney issues additional shares of common stock through an investment banker this would be a secondary market transaction. Which of the following is a primary market transaction. Which one of the following is a primary market transaction.

Making the first transaction of the day with your brokerage firm. In secondary market transaction already issued securities in primary market are traded. An investment banker arranges the transaction.

No comments for "1 Which of the Following Is a Primary Market Transaction"

Post a Comment